Everything You Need To Know About Your Form W-2

Though this year seemed long, it is coming to an end. Amongst other things, this means your employees will soon have to file their annual income tax returns. Before they can do so, they will need a Wage and Tax Statement, or simply, their 2020 Form W-2.

Regardless of whether you’re a seasoned business owner or just beginning, you need to be familiar with the W2. Understanding its purpose and layout will facilitate you being able to distribute them to your employees.

2020 Form W2 (Remember the #6)

Obtaining the form is simple. It’s readily available online as a PDF and can be downloaded. If you’re wondering who has to be given a 2020 Form W-2, then you need to remember the number 6.

Any employee who makes more than $600 is required to receive a W-2. It doesn’t matter the hours they worked or the position they held. The reasoning behind this is taxes.

You have to withhold Social Social Security and Medicare (FICA) on their behalf. The W2 documents the money that has been earned as well as what has been withheld.

This began with me saying to remember the number 6. Not only do you need to issue W2s to employees who made over $600, but you also need to make 6 copies per employee.

Copy A is the most distinct because it is done in red ink and goes to the Social Security Administration. Then Copy 1 is sent to the applicable local governing body (state, city, etc), and then Copy D is kept by you.

That leaves three more. All of which go to the employee. Copy B is for reporting federal income taxes, and Copy 2 is for state, city or local taxes. The last one, Copy C, is for your employee’s records.

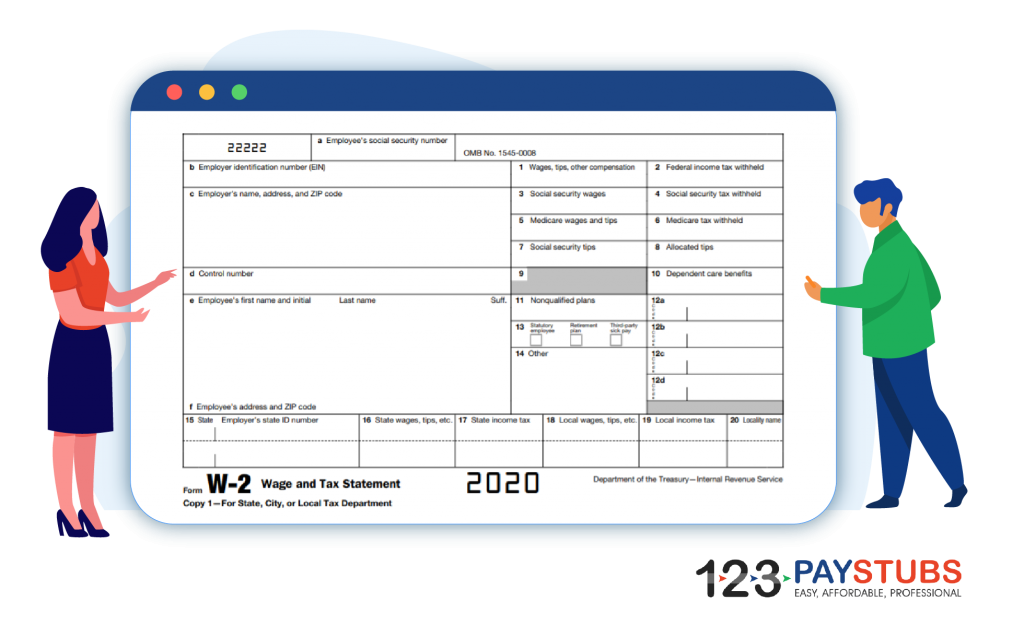

How To Complete The Lettered Boxes

Box a: Social Security Number

Box b: Employer EIN

Box c: Employer’s Legal Address

Box d: Control Number (if applicable/not required)

Box e: Employee’s Name (as it appears on their SSN card)

Box f: Employee Address

Numbered Boxes 1-10

Box 1: Total Taxable Wages

Box 2: Total Federal Income Taxes Withheld

Box 3: Total Wages Subject To Social Security Tax

Box 4: Social Security Tax Withheld for the Year

Box 5: Wages Subject to Medicare Taxes

Box 6: Amount of Medicare Taxes Withheld for the Year

Box 7: Tips (Reported by Employee to Employer)

Box 8: Tips (Any You Have Allocated To Your Employee)

Box 9: This is for the 16-digit verification code. When either your or your tax professional file electronically, it’ll prompt you to enter it. Although this number is on your W2, not entering this code should not cause your form to be rejected by the IRS.

Box 10: Total Amount Paid Towards Dependent Assistance (if applicable).

Numbered Boxes 11-20

Box 11: Amount Given To Employee Through a Non-Qualified (Taxable) Deferred Compensation Program.

Box 12: This is a catch-all. Anything that needs to be included that has not been included already can be done so here. There are 31 different corresponding codes (A through FF). Box 14 is also a catch-all.

Box 13: There are three options to choose from. Check the box if your employee is a statutory employee. This an independent contractor who is considered an employee only for tax withholding purposes. However, they are only subject to Social Security and Medicare. Federal income tax will not be withheld. The second option is for if your employee was part of your retirement plan benefit, and the third is if they received sick pay under your insurance policy.

Box 14: See Box 12

Box 15: Your State Tax ID Number and State (Where Your Business is Centrally Located).

Box 16: Total Amount of Taxable State Wages

Box 17: Amount of State Wages Already Withheld for the Year

Box 18: Local Taxes (if applicable).

Box 19: Amount of Local Taxes Already Withheld for the Year.

Box 20: The Name of the Locality the Above is Being Withheld For (City, Town, etc).

123PayStubs

This is where you have a choice: how complex are you going to make this process? Though there is a significant amount of information required here, if you document your payroll and payments, then this process becomes infinitely easier.

The key is to stay ahead of your documentation. When you make a payment to a contractor (especially if it is over $600), create a pay stub. The calculations will be done for you. Then file it away until it is time to do your annual taxes.

E-File your 2020 Form W2 through 123PayStubs for only $3.99.

Try 123PayStubs Today!

Leave a Comment