Everything You Need to Know About Paystubs

When it comes to generating pay stubs, unless you’re doing the actual work, you may not realize exactly how important it is. A pay stub is a very important document for managing income, tracking an employee’s withheld taxes and showing proof of income.

Understanding the importance and required information for a pay stub is necessary for properly generating the pay stub for your employees. Let’s take a complete look at it.

What is a paystub?

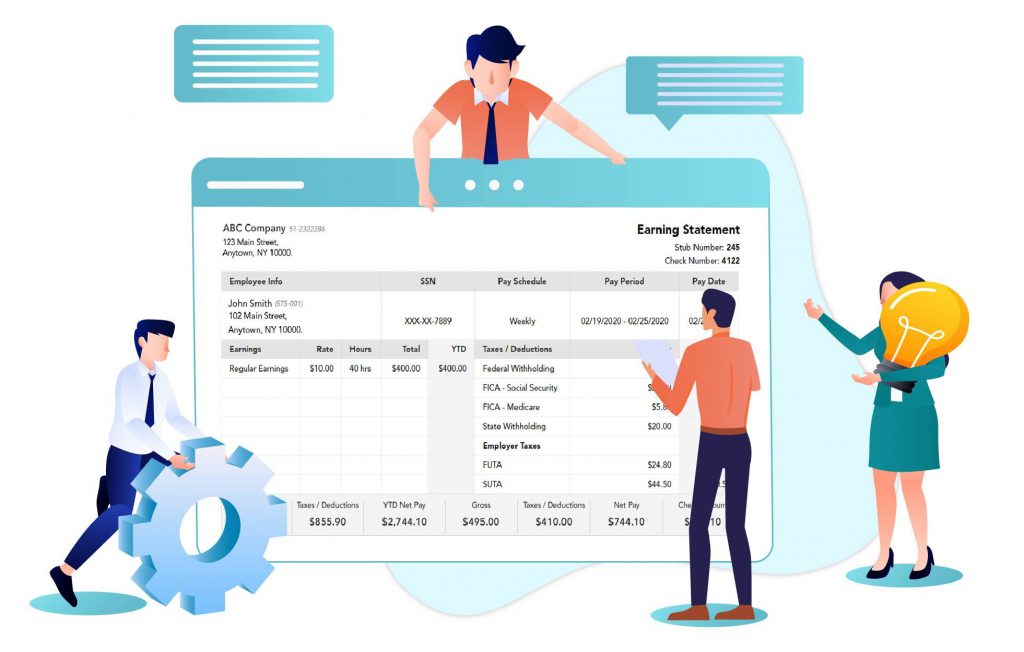

A pay stub is essentially the part of a paycheck that reflects details regarding an employee’s pay schedule. A pay stub itemizes any wages earned for a specific pay period and year-to-date totals. Also, the pay stub shows any taxes and other deductions withheld from an employee’s earnings. More importantly, a pay stub shows the amount an employee receives in net pay.

It’s important to note that a pay stub is commonly used to reflect proof of income in circumstances for home or auto loans. The information provided on a pay stub should be specific, accurate and is required to contain certain information.

What information is required to generate a paystub?

Generating a pay stub only requires a few essential components to be complete. It is commonly understood that there are three primary components that are required to accurately reflect the necessary information:

Company Details – This generally includes your company or business name, the company’s physical or mailing address and their IRS-issued Employee Identification Number.

Employee Details – The information required here is the employee’s name, their Social Security Number and their filing status (single, married, or head of household). The employee’s mailing address is not required but is often added for further identification.

Pay Schedule Details – This involves any details regarding an employees’ salary that indicates whether they are paid hourly or are salaried employees. A pay stub should also reflect the exact dates of the pay period, all hours worked, the employee’s gross pay, any deductions, whether they be required or at an employee’s request and finally, the employee’s net pay

This information is necessary for accurately calculating state and federal taxes, in addition to FICA and any additional withholdings. If your pay stub generator handles tax calculations for you, be sure you’ve provided the correct state for deductions to be accurately accounted for. Deductions vary from state to state and improper deductions can be costly to both the employee and employer.

How do I generate a paystub?

Generating a pay stub online is much easier than you may realize. An ideal pay stub generator should function in just a few basic steps. Simply enter the required information, as we mentioned above, and if allowable, upload your company’s logo or crest to reflect a more professional touch.

The next step is to review that the calculations are accurate and the information you’ve provided has been correctly reflected in the pay stub template.

At this point, simply download the pay stub template as a PDF. The only step left is determining how you plan to deliver the recipient’s pay stub.

Click here to generate paystub in less than 2 minutes

How do I print or email a pay stub?

Once you’ve generated your pay stub online and downloaded it as a PDF, you can print it as you would any other document. It’s important to keep in mind that if you’ve paid for a pay stub with a nice color logo, you’ll want to be sure color printing is available.

The final step is to simply decide how you plan to deliver the pay stub to the intended recipient, whether that be via email or printing and mailing or hand-delivering their pay stub.

If you plan to email your recipient’s pay stub, simply upload the PDF to the email and send it. The file will then be fully accessible to the employee or contractor.

How do I correct a paystub?

After generating your pay stub, it is recommended that you preview and edit any errors. If an online pay stub generator allows you to make any corrections, it will usually only be allowable before making a purchase.

Generally, you will be allowed to make unlimited corrections to edit details such as your employee’s or employer’s name and pay period.

If you need to make additional changes, you may be asked to contact the Support Team of your chosen online pay stub generator.

What are the best pay stub templates?

A reputable online paystub generator should and will provide you a few different options for pay stub templates. These options should include variations of basic to professionally designed templates, with optional color choices to reflect the design of your business. Additionally, an image upload function that allows you to add your business logo or company crest can add a bit of flare to your pay stub.

It might seem a bit intimidating, but a solid online pay stub generator should be able to handle all of these with ease. Searching for the best option shouldn’t take a lot of time. The essential tool for your payroll needs is just a few clicks away.

Understanding the overall importance of a pay stub is crucial to successfully take on the payroll for your small business. Managing these responsibilities in a cost-efficient manner can save you time as well as money.

What is the best pay stub generator?

123PayStubs is the user-friendly paystub generator that handles your uploads, tax calculations, provides unlimited cost-free corrections and professionally-designed pay stub templates all at the lowest cost in the industry!

Generate your pay stubs in three simple steps, download and email or print quickly and easily with 123PayStubs and enjoy worry-free accurate year-to-date tax calculations including FICA taxes, FUTA, and SUTA.

Stop fumbling around generating low-quality, spreadsheet-based pay stubs. Your employees rely on you for more than financial income. Let 123PayStubs handle your calculations, templates and delivery options today!

Your first pay stub is completely free just for signing up. If you need help, our US-based Support is available via chat and email 9-6 EST to help make your payroll needs easier.

Leave a Comment