Why Taxes And Deductions On Your Pay Stubs Need To Be Accurate

There are multiple reasons why the taxes and deductions on your pay stubs need to be accurate. Not only are they critical in tracking how much money goes in and out of your business, but they are the cornerstone of filling out taxes.

Your employees will use the taxes on their pay stubs for their annual returns. You will use them to file on behalf of your business. If the deductions on the pay stubs are not correct, then they could potentially be receiving a bill to account for the remaining balance.

If you’re taking the time to accurately manage the taxes on your pay stubs, ensuring that you’ve entered each piece of information correctly, you should also reap the reward of having your forms being accepted.

Here are some other reasons why the taxes and deductions on your pay stubs need to be accurate.

Your Legal Responsibility

Within the federal government, there is the U.S. Department of Labor. One of their unique responsibilities includes overseeing regulations and state labor laws.

For instance, when you are sitting down to decide whether your employees are exempt or nonexempt (overtime), you are not free to come up with a conclusion on your own. There are guidelines and standards set forth by the Wage and Labor Division that operates inside the US Department of Labor that will dictate how you label and pay your employees.

If you ever held a job where you had to punch out during a break—even if it was a paid break—because the company was likely documenting that you were given one. Just like wages, there are rules and requirements for meals and rest for certain types of employees.

As an employer, failure to adhere to wage and hour laws can result in financial penalties. This could include even paying the employee back for the money you owe him/her. Furthermore, you could face a lawsuit in a civil trial and be forced to pay back wages in addition to attorney’s fees. Gross and deliberate negligence could end in criminal charges being filed against you.

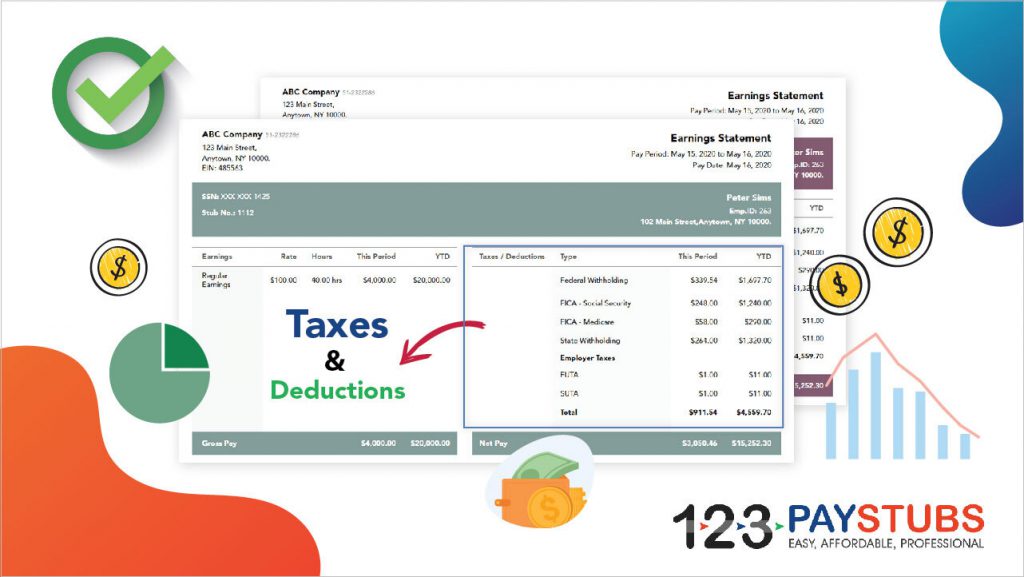

Withholdings

In previous posts, we’ve talked about the Federal Insurance Contributions Act (FICA). Because this an Act that was voted on and passed by our elected officials, you, as an employer have a legal obligation to abide by it.

FICA includes Medicare tax, Social Security tax, and federal income tax. As an employer, you are responsible for paying your share of Medicare, Social Security, and unemployment tax as well.

If you do not with deduct the right amount—or don’t deduct any at all (employees only)—the agency to whom you owe money to can file a tax lien against you and the property you own And this too could result in prosecution.

Tax Filings

Your employees are required to file their income taxes annually. They cannot do this without you supplying them with an accurate W-2. Errors on your end will prevent your employees from being able to file their returns.

Generate Pay Stubs with Accurate Tax Calculations

Details about your employees start with their W-2/W-9s, then they get added to their pay stubs, and those pay stubs will be used when taxes get filed.

By using a pay stub generator like 123PayStubs, you are guaranteed to have accurate calculations for all taxes and deductions. Don’t have a weak link in your chain.

Try 123PayStubs Today!

Leave a Comment