Easy Tips For Generating Pay Stubs Online

Navigating the various aspects of payroll can initially be daunting for a small business owner or newly appointed HR representative. Finding the best pay stub generator can save a lot of time and headaches when it comes to running payroll.

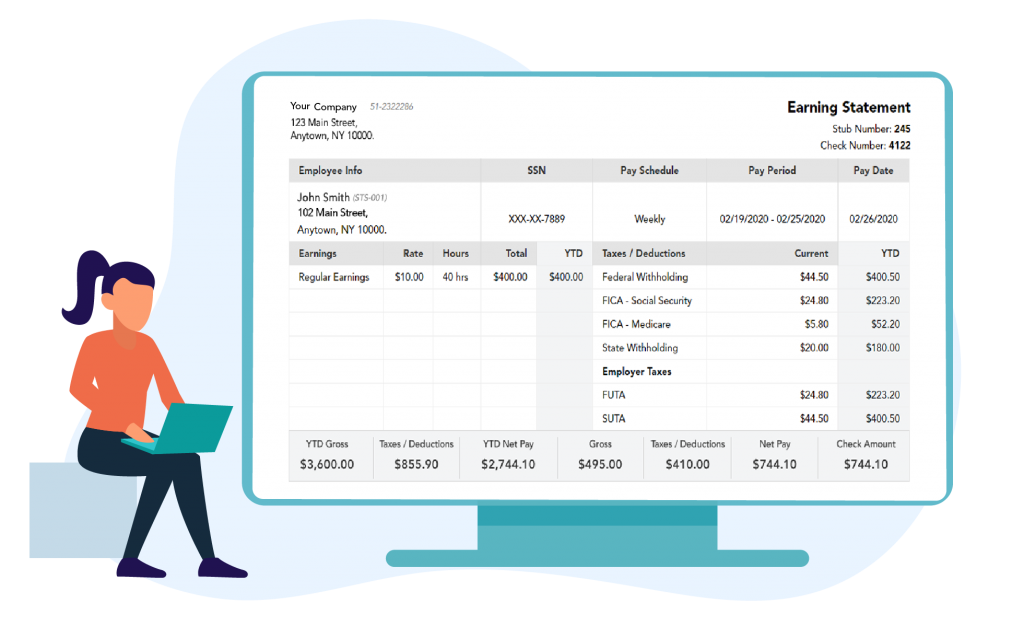

A pay stub is a document that reflects a breakdown of hours worked, hours paid, tax distributions and any additional deductions or reimbursements that reflect proof of income.

Basic Information required to Generate Pay stub?

Depending on which state you are in will determine what your pay stub should include. It’s important to note that a few states don’t require an employer to provide a pay stub. In states that do require you to provide a pay stub, the laws can vary as to what information is required.

When it comes to generating pay stubs, there’s some information that’s essential.

First, you’ll need to provide your company’s information. This should include your company’s name, address and Employee Identification Number (EIN). Be sure to include the state your business is in to determine the correct Withholding tax to be calculated.

You’ll also need to provide the employee or contractor’s information.

To generate a pay stub, you’ll need to provide their name and social security number. You’ll also need to include the employee or contractor’s salary, hourly wage amount or gross earnings. Any net earnings, deductions or reimbursements should be reflected as well.

If you haven’t already done so, you’ll need to calculate the employee’s tax information, such as Federal and state income tax, FICA taxes, which includes medicare and social security taxes.

What are the most cost-efficient ways to generate a pay stub?

Generally, the most cost-efficient method for generating pay stubs is online through a website or software. Some free pay stub generators simply take the information you provide and format it for you. This requires you to make sure calculations for all state and federal taxes, as well as FICA taxes are accounted for.

If you decide to use an online pay stub generator, there are a few things you may want to look for:

- Tax Calculator – If you’re handling payroll, you know how important accuracy is. Making a mistake on a pay stub can be frustrating for both you and the employee. A good online pay stub generator will have the ability to handle calculating year-to-date state, Federal, FICA, FUTA & SUTA taxes accurately and efficiently.

- Professional Template Designs – Paystub generator should provide the pay stub template options in varying formats, patterns and colors to reflect your business.

- Pricing – Pricing is the most important aspect of a solid online pay stub generator. Some pay stub generators claim their services are the lowest priced. But what are they charging for? Pricing is more than the basic cost of generating a pay stub.

- Simplicity – An online pay stub generator shouldn’t be complicated or tricky. A few simple steps of entering the necessary information, reviewing and downloading to print or email should be all that’s required.

Find an online pay stub generator that offers a comprehensive service at a low cost that works with you. Saving time and money on payroll includes the hours you spend doing work the right tools should do for you.

123PayStubs allows you to generate, print and email pay stubs online in three easy steps. All your Year to Date calculations(YTD) is handled accurately, including FUTA and SUTA taxes at the lowest price. Also we supports 2020 Form W-4 for withholding calculations. Your first pay stub is free.

Leave a Comment