How to Create Payment Statements for Contractors

When you hire someone as an independent contractor, you will need to document and pay them accordingly. As an employer, the paperwork you file and the deductions you account for will differ depending on their classification.

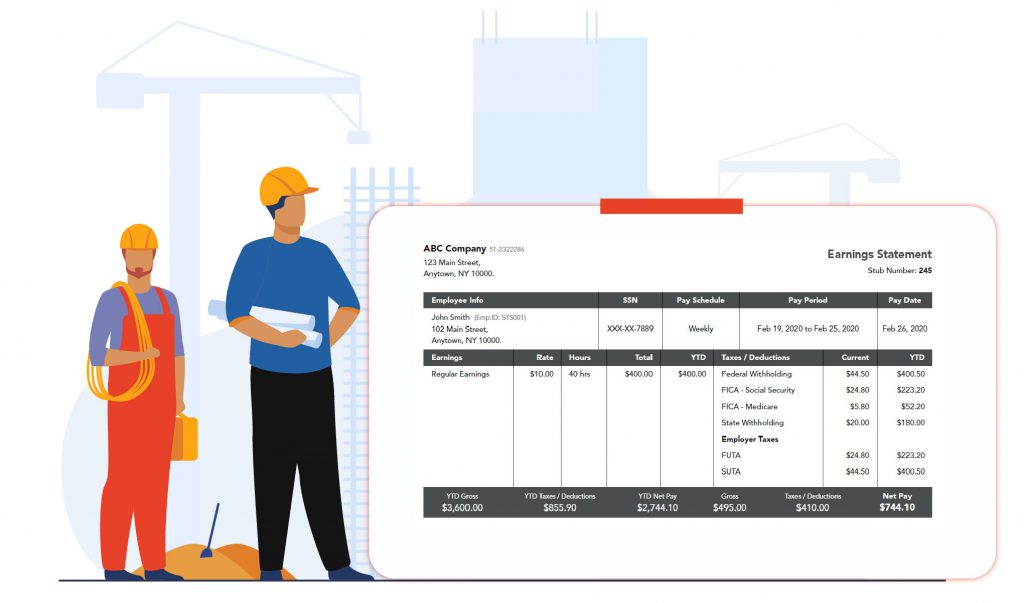

The payment statements for contractors will not include federal or state withholdings, nor will they have FICA taxes (Medicare, Social Security). This is not to say that they will not have to pay for them. Even though pay stubs for contractors will not list out itemized deductions, the independent contractor will be liable to pay them when they file their annual taxes. Think of it this way: the responsibility to pay taxes doesn’t disappear; the person who is responsible for paying them shifts from you to the contractor.

Form W-9

Upon hiring a new contractor, have them fill out a W-9 immediately. It is required that you provide this form for anyone who will earn more than $600 who isn’t being hired as an employee.

Filling out this form will be relatively easy for both you and your newly-hired contractor. Including the instructions, the form is about a page long. As an employer, all you’ll need to provide is your Employer Identification Number (EIN).

Your contractor will have to give their full legal name, their business name (if applicable).

Lastly, they will need to provide some version of a Tax Identification Number (TIN). This can either be their Social Security number, or their Employer Identification Number, if applicable.

Creating Paystubs for Contractors

Making contractor pay stubs can be as easy as filling out the W-9. And with 123PayStubs, it will be. Pay them quickly and accurately while also creating a professional-looking record of the transaction.

First, fill out your company’s information. You will have the choice to add a company logo and choose a paystub template that matches the aesthetic of your business.

Upon completing the company information section you fill in the exact information they’ve already provided in their Form W-9.

Now, this is where the magic happens, when the simplicity and efficiency of 123PayStubs does your work for you.

By entering in the pay schedule, pay period, and payday, 123PayStubs can begin to generate a pay stub for your contractor. When you add your gross earnings (money earned before taxes and deductions have taken out), the money they earn per hour, and the number of hours worked, then the total will be calculated.

Another added feature of using 123PayStubs for your contractor paystubs is that it stands as an accurate record of the money being paid out. As you continue to use 123PayStubs you can easily tally all of your Year-To-Date (YTD) totals because they’ll be listed out for you.

Remember how we discussed the W-9 and that it was needed for any contractor who earned over $600? For those same contractors, you’ll need to file a 1099 at the end of each year to report their income to the IRS. This stands as a notification to them they should be expecting money. All of your payment statements to your contractors (your contractor’s pay stubs) will be crucial to filing this accurately.

Although it is not your responsibility to pay the taxes, it is your job to report their earnings properly. That amount is a direct reflection as to how much money is owed by the contractor.

123PayStubs allows you to maintain accurate and professional-looking paystubs for your contractors.

Try 123PayStubs Today!

Leave a Comment