How to Create Paystubs for Your Gig Workers

Despite the classification that your employees fall under, you need to take care of them. Because they support your business you need to support them. Making paystubs for gig workers might present a challenge, but we can help with that.

One type of worker that has become more popular due to the tech industry, is the Gig worker. Companies like Amazon Flex (an online delivery service) and Airbnb (an online home rental service) are both businesses within the gig economy. We’re going to take a look at what a gig worker is and 123PayStubs can be an invaluable tool to help you generate paystubs for gig workers.

What is a Gig Worker?

Gig work can also be called non-traditional work. It is a way to earn income that falls outside of traditional ways to make money. For example, any sort of long term employer-employee relationship would be closer to what would be considered traditional work.

One way to define a gig worker is someone whose employment is based on a work arrangement. This could be a specific contract or a relationship defined by you, the employer. You might want the work to be based around a project or for them to work for a set period.

In some cases, you might be their employer but the company that pays them is different than the one they work at for you. These are called nonstandard or alternative work arrangements. This could apply to you if you’d hired a temp worker from a temp agency.

Gig Worker Tax Classification

As an employer, a fundamental piece of being able to pay your employees is understanding their tax classification. They will still either get a W-2 (employee) or a 1099 (contractor). If you determine that they are employees, then they are eligible for benefits. You’ll be required to deduct payroll taxes, and they will be protected by minimum wage laws.

If your gig worker is an independent contractor, then they receive a 1099 form. Though you will not have to deduct payroll taxes when you generate a paystub for your gig workers, you will have less oversight as to how they perform their jobs. Think of this way: You could tell them to make a cookie by a certain date, but they will decide how and when it gets baked.

Depending on the nature of the business you are running, hiring an independent contractor may be good or bad based on the schedule you’re looking for them to keep, your ability to be flexible, and your willingness to give up some direct oversight.

The Kinds of Work Done By Gig Workers

I want to go over the kinds of occupations that would employ a gig worker. It’ll give you an idea as to whether your business model pairs up with any of them.

Although Uber and Lyft are excellent examples of companies who employ gig workers, it would be a mistake to think of that definition as all-encompassing. Gig workers work across an array of industries and jobs. They design websites, provide consulting (managerial, accounting, etc), they care for homes and children.

As an employer, you need to know this tip about gig workers: the type of work they do does not matter. It’s how you organized, controlled, and managed.

How to Pay Your Gig Workers

Gig workers are usually paid by the task or project rather than by the hour. This is where it would be good to consider how you’d generate paystubs for your gig workers. Document the money you pay your workers. Don’t fall into the trap of paying them in cash or “under the table” because wages are taxable. Granted there is a threshold ($12,000 for people under 65) to make before their cash earnings need to be reported, but there is no reason for you to expose yourself to any sort of legal repercussions.

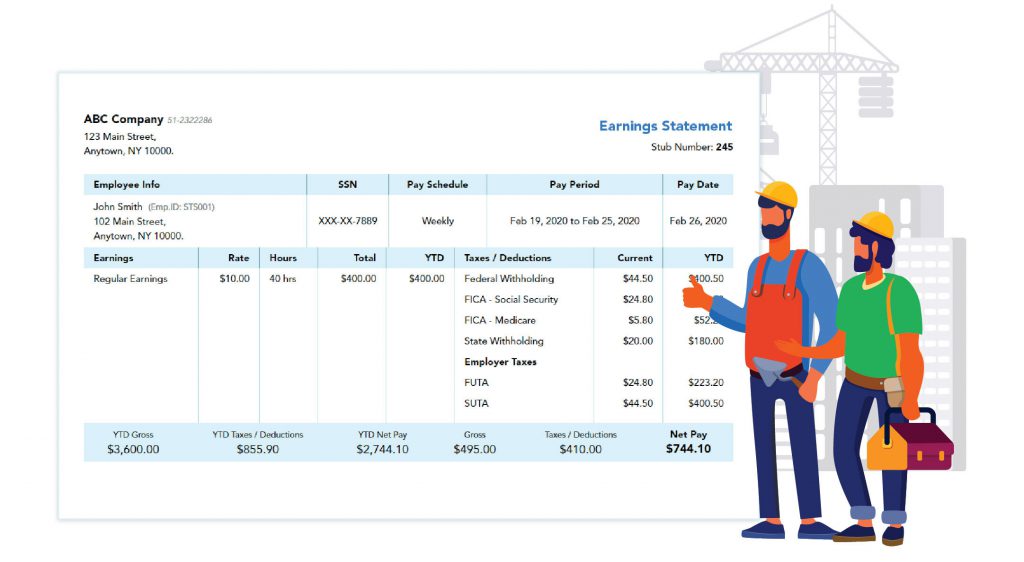

Paystubs for your gig workers is also a way of taking care of them. For example, if they ever go to ask for a loan, they will need proof of income. Simply put, piles of cash and your word that you pay them is not going to suffice for proof of income. A paystub generator is an easy and efficient way to document income. And because so many gig workers are based online, using a paystub template is a clean and professional way for your employee or contractor to have something physical with your logo on it.

Leave a Comment