How To Create Paystubs For Employees And Contractors

With 123PayStubs you’ll discover how easy it is to create paystubs online. Whether you are seeking to generate paystubs for employees or paystubs for contractors, the degree of difficulty is minimal. The whole process can be done in under 2 minutes. It is simple and efficient. You will be able to see all of the Year-to-Date (YTD) calculations as well as additional earnings and deductions.

Contractors vs. Employees

What is the difference between the two? This is a common question. Millions of workers are misclassified every year.

As an employer, if you control the result of the work but not how it is done, then you would file that worker as a contractor. Think of it this way: you get to choose what the cake looks like, but you do not get to dictate how it gets prepped and baked.

Are there benefits included with employment? This would usually indicate that the worker is an employee. Is there a contract involved? And if so, is the working relationship over when the project is complete? This would signify that the worker is a contractor.

As an employer, how much control do you have over the financial aspects of the job? This includes things like equipment and reimbursement. The more control you have over either, the more it would indicate that you have hired an employee.

Unlike employees, contractors receive a Form 1099 – MISC whereas an employee would get a W-2.

For more information, look here.

Company Information

This will be the same for both a contractor’s and employee’s paystubs.

When you use 123PayStubs to generate your first paystub for an employee or a pay stub for a contractor, it’s free. To get started, enter your company information. This includes your name, address, Employer Identification Number (EIN).

To make your pay stubs more personal to your business, you will have the option of uploading your company’s logo.

Denoting an Employee or a Contractor

After you’ve filled your company’s information, in the section beneath it, you will have the option of choosing whether you want to generate a pay stub for a contractor or an employee.

It’s that simple.

You’ll notice that when you choose “Contractor,” the option for filing status disappears. For contractors, you will not have to account for their state and federal income taxes, hence you will not have to denote if they are filing as married or single.

Despite the type of worker you are generating a pay stub for, you will need their name, their employee ID (if applicable), and the last 4 digits of their Social Security number.

Earnings Information

Whether you are making a pay stub for an employee or a contractor, you only need to enter the appropriate information.

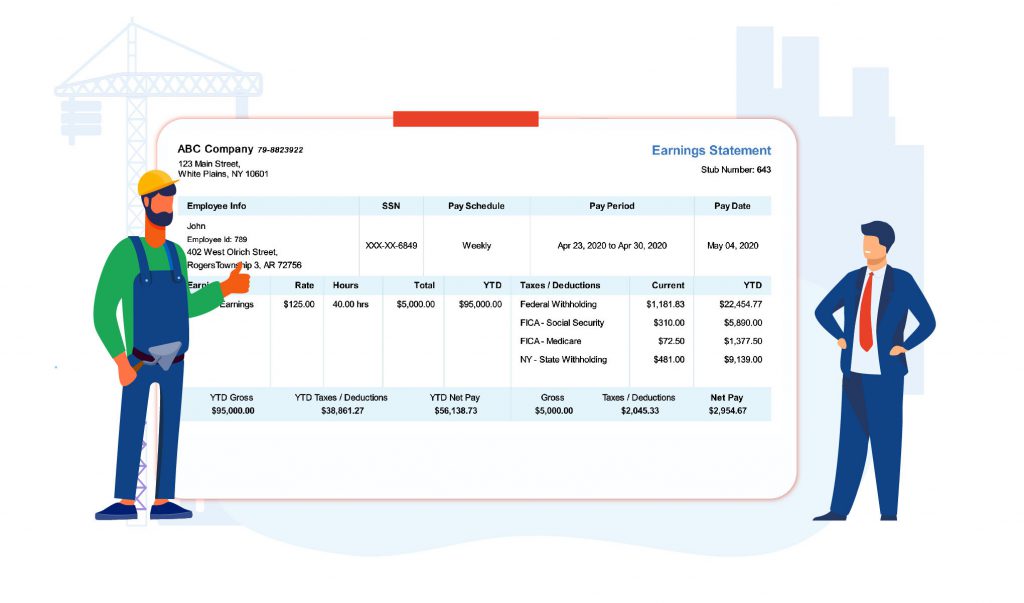

Before 123PayStubs can accurately and quickly generate a pay stub for you, you will have to enter the information under “Earnings Statement.”

As an employer, you’ve already determined this. You only need to enter it in. This includes the payment schedule, pay period, and the pay date.

In this section, you can include additional earnings for things such as bonuses and overtime. Should you need to add other deductions, you can do that here as well.

When complete, you will be able to preview what you’ve entered. Afterward, you will be able to download, print, or email your pay stub. When you create a paystub online, you can come off professional and save yourself time.

Why 123PayStubs?

With 123PayStubs, you can generate a pay stub for an employee just as easily as you can for a contractor. You can choose to do it on your phone or computer. It’s as simple as it is accurate.

Checkout this video to know, why 123PayStubs is the best pay stub generator.